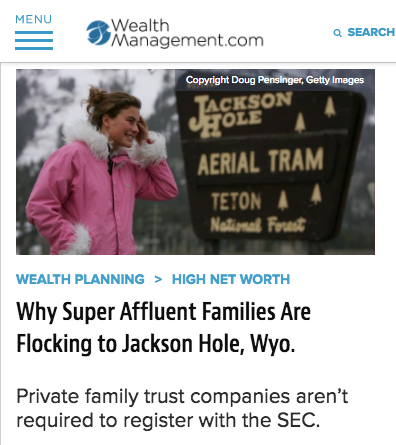

Private family trust companies aren’t required to register with the SEC.

By Melvin A. Warshaw / November 10, 2017

A regulated private family trust company, called a “Chartered Family Trust Company” in Wyoming, can be useful for extraordinarily wealthy families who seek the flexibility of PFTCs and their regulation by the Wyoming Division of Banking.

A regulated private family trust company, called a “Chartered Family Trust Company” in Wyoming, can be useful for extraordinarily wealthy families who seek the flexibility of PFTCs and their regulation by the Wyoming Division of Banking.

On July 1, 2015, Wyoming enacted the Chartered Family Trust Company statute. If chartered by the Wyoming Banking Board, a PFTC isn’t required to register with the U.S. Securities and Exchange Commission. To fall within the current exception from registration with the SEC, a family office must provide securities advice only to members of a single family, be managed and controlled by the requisite family members and entities and not hold itself out to the public as an investment advisor. Wyoming-regulated PFTCs are required to maintain a minimum capital of $500,000, have a physical office in Wyoming and be examined by the Wyoming Division of Banking at least once every three years, among other requirements.

The CFTC statute attracts wealthy families to Wyoming, where they can enjoy the following benefits:

- Exemption from Investment Advisors Act of 1940 After Dodd-Frank

- Pooling and Commingling of Family Assets

- Create Continuity of an Independent Trustee for all Family Trusts

- Elimination of CRS Red Tape for Non-U.S. Residents

Read the full article on WealthManagement.com